2026 Trend Reveal - Cosmetic Trend Forecast for 2026

Reflecting on 2025 consumer behavior of the online and in-store cosmetic shopper and making predictions for potential in beauty innovations and trends in 2026.

Credentials: I've been working in various Sephora, Ulta, and Nordstrom stores speaking with clients. Also participating in active discussions and communities of beauty enthusiasts and novices alike.

December 2025

Sorry to bring up 2026 already but the new year is almost here! I'm here to give you some food for thought when it comes to your own shopping behaviors and what to expect in the coming year for hot new cosmetic items. We're done with being insecure and we're shifting to conscious consumerism of products that make us feel great in our own skin instead of covering it up. We're also smarter. Here's six trend predictions for the beauty industry for 2026.

Asian Inspired Beauty

Americans are discovering the price disparity between US and Asian cosmetic markets. With YesStyle opening a new store in Silicon Valley (Simon) it won't be long before the US market is forced to compete with the fair pricing and high performance of Asian beauty brands.

There is great opportunity for Asian inspired color cosmetics in the western market. Cushion foundations for example have great potential in the US market, for simplicity of use and natural finish. Current liquid foundations result in creasing and difficulty of application for many consumers and, the market has responded with skin tints as a solution. If a brand like Kosas were to introduce a full line of cushion foundations (TirTir), jelly blush compacts (Reddit), and long wear water tints (YesStyle), it would have huge impact on the way western markets used makeup. However, consumers need to have access to these types of products in-stores like Sephora in order to fully popularize.

Cushion foundation, cushion bush, water tint.

Neutral Aesthetic Packaging and Product Transparency

Customers are smarter and no longer can be tricked into buying something because it's cute. Brands like Glow Recipe and Drunk Elephant had their moment in the sun but ruined colorful packaging for the informed consumer when these brands chose to cater to the younger market.

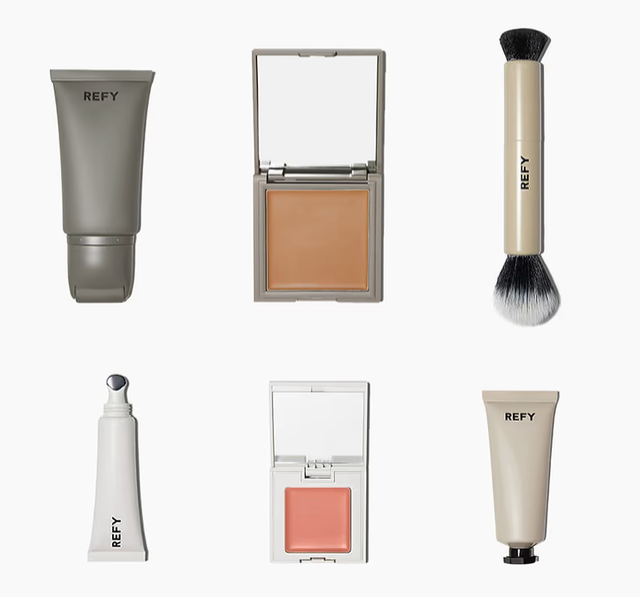

Current active cosmetic consumers are informed, looking for simple formulas with quality performance. Rhode is the best current example of this along with Refy and Crown Affair. Businesses are making the most of existing and packaging components keeping customizations to a minimum (which also saves money on factory costs), while delivering satisfactory collections worth repurchasing.

The key to success with neutral aesthetic brands will be life style marketing. Money saved on manufacturing should be allocated to market research on the 2026 updated "clean girl" audience, whom is most likely to share these products with their friends and followers. This is also the customer who will be most engaged in beauty purchases in the next ten years so gaining their trust now with transparent and effective products can be critical brand longevity. I think we are bound to see more brands presenting us straight forward products that slide into the background of our daily lives.

Peptides for Everyone

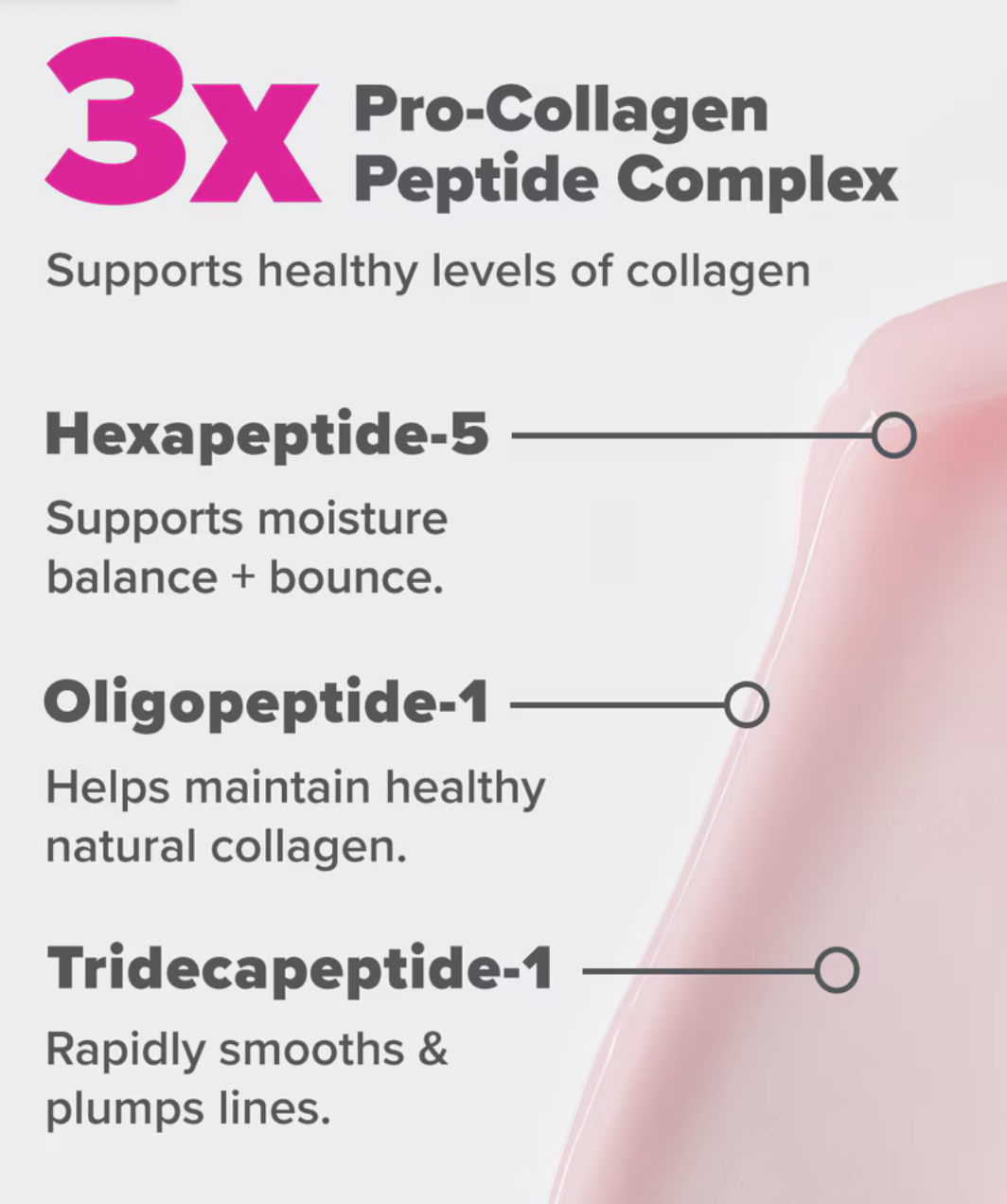

Popular in lip products, peptides are making their way onto the preferred ingredient list for skincare. Customers want anti-aging but are nervous about retinol or traditional "anti-aging" ingredients. Beauty culture is de-centering the fear of aging and leaning into longevity. Clients are willing to sacrifice "clean beauty" tags if the brand presents as scientifically creditable and in compliance with EU standards. Peptides have been used in the fitness world for many years (biohacking) and are moving to center stage in the skincare world.

Brands like Paula's Choice and Olehenriksen are leaders in popularizing effects of peptides. While brands like Lawless Beauty and The Outset are sneaking peptide complexes into their lip products under the name MaxiLip. Peptides are soon going to become known as the real youth extending ingredient and, customers are likely to ask for peptides over retinols when it comes to age prevention treatments. Cosmetic labs already have extensive research on peptide formulas and are ready to put them into products. Brands like ZO Skin should to continue to educate consumers on peptides as there are 100+ peptide options.

Lip images from Lawless Beauty and Peptide Complex Image from Paula's Choice

Actives in Body Care

Customers are actively seeking effective exfoliation for the body in a no mess form. Sugar scrubs are out, BHA's are in. Brands are getting creative with body products and there is sure to be continuation in innovation. We're going to start seeing not just exfoliation but, other active ingredients mimicking skin care trends for the face. In addition to actives we're also likely to see an increase in spray (First Aid Beauty Body Acne Clearing Mist) and bar (Soft Services Buffing Bar) delivery systems. Customers want body products that are easy to use or, fit into their established routine. Traditional body scrubs have been the only option and consumers are excited to bee the body category grow.

First Aid Beauty Body Acne Spray and Soft Services Buffing Bar.

Mini Shadow Palettes

People (who don't already have a collection of eyeshadow from the early 2010's) see waste in large eyeshadow palettes. When customers come in looking for eyeshadow they want more than a single pan but less than 18 pans. Natasha Denona hit the mark with the mini series, giving customer five easy to use shades in more or less neutral tones, that can easily be thrown into a travel bag at $27USD. Hourglass tried to replicate the success of Natasha Denona but saw many returns on their Curator Eyeshadow Quads, priced at $69USD. With 2000's trends coming back into fashion eyeshadow is posed for a rebound. Customers still see art in makeup and giving them accessible options without overwhelming them with 16 shades will see success. Recent online tutorials are featuring pressed eyeshadow over shadow sticks, even though there have been several shadow stick launches in 2025. Again, one color is not enough and shadow sticks are priced around $20-$36 a piece.

Popular Natasha Denona mini palette, overpriced Hourglass quad, and Niki La Rose with a new eyeshadow tutorial.

Long Wear Lip Stains

The market still yearns to answer the call of a long wear, non-drying, medium pigment lip product. Currently a close answer to this call is the Benetint by Benefit but, this product comes a liquid that is unfamiliar to the mass market and is drying. Customers want lip color that lasts in a flattering finish, that's also easy to use without a mirror. A notable attempt at meeting this demand is the Huda Beauty Lip Stain Contour. However those who purchased this product found it difficult to use due to initial lack of education and un-intuitive design (LipstickLesbians). There is a lot of room for innovation in the hydrating lip stain category. Brands would be wise to invest time in developing a long wear gloss stain, similar to the Asian water tints mentioned above. This will push factory and formulation lab capabilities alike. If wear time of 5+hours (consider eating and drinking) can be achieve the product would be positioned for vitality.

Benetint which is literal liquid and drying and the new Huda Contour Stain which was "too complicated" for users.

Thank you so much for taking the time to enjoy my trend forecast for beauty in 2026. These conclusions are based on my personal experience working in the cosmetic industry and an analysis of thoughts presented by other beauty industry research driven minds.

Please take a moment to sign up for my email newsletter at the top of this page so you can get articles like this delivered directly to your inbox. You may also be interested in my previous posts including a look at Dior's brand DNA and my thoughts on Bioengineered Skincare Ingredients. If you know someone who would also enjoy these articles, send them along!